- 2nd Floor - Building No. 02, Anupuram Vihar, Block Office Road, Haldwani

- +918979040814

- info@firstplan.in

Spotting the Dawn of a Bullish Trend Unlocking the Power of the Three White Soldiers Candlestick Pattern

Understanding the Three White Soldiers Pattern

In the ever-shifting world of financial markets, traders rely on visual cues to anticipate the next big move. Among the most powerful of these signals is the Three White Soldiers candlestick pattern—a formation that often marks the turning point from bearish gloom to bullish optimism. Recognizing this pattern can help traders seize early opportunities as markets begin to rally.

What Defines the Three White Soldiers Pattern?

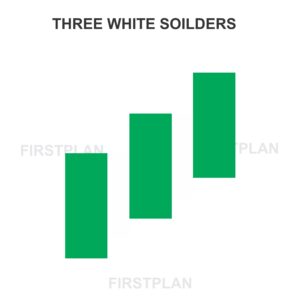

The Three White Soldiers is a bullish candlestick pattern that emerges after a downtrend or a period of sideways consolidation. Its appearance suggests that the tide is turning, with buyers stepping in to drive prices higher. This pattern is composed of three consecutive bullish (often green) candlesticks, each closing progressively higher than the last.

Key Elements of the Pattern

Breaking Down the Anatomy of Three White Soldiers

Candle by Candle

Visualizing the Pattern

Picture three tall, green candlesticks lined up in succession, each one reaching higher than the last. Their bodies are robust, and their shadows are short or nearly absent—an unmistakable sign that buyers are firmly in control.

What Does the Three White Soldiers Pattern Signal?

The appearance of this pattern is a strong indication that market sentiment is shifting from bearish to bullish. It reflects growing confidence among buyers, suggesting that the worst of the selling may be over and a new uptrend could be underway.

Real-World Example of the Three White Soldiers

Let’s bring the pattern to life with a practical scenario:

Each day’s candle opens within or near the previous day’s body and closes higher, perfectly illustrating the Three White Soldiers pattern.

How to Trade the Three White Soldiers Pattern

Confirming the Signal

While the pattern itself is a robust indicator, confirmation from other technical factors can increase its reliability. For instance, rising trading volume during the formation of the pattern often signals genuine buying interest.

Entry and Exit Strategies

Variations and Opposite Patterns

Additional Insights for Savvy Traders

Market Sentiment

The Three White Soldiers pattern is a visual representation of a gradual and sustained shift from bearish to bullish sentiment. The lack of long shadows or wicks on the candles suggests that buyers are consistently pushing prices higher, facing little resistance from sellers.

Ideal Trading Conditions

This pattern is most reliable when it appears after a prolonged downtrend or a period of consolidation. Consistency in candle size and the absence of long shadows further enhance its credibility.

The Role of Trading Volume

A spike in trading volume during the formation of the Three White Soldiers adds weight to the bullish signal, indicating that the upward move is supported by strong market participation.

Why Recognizing the Three White Soldiers Matters

Mastering the identification of the Three White Soldiers pattern can give traders a significant edge. By spotting this formation early, traders can anticipate potential trend reversals and position themselves to capitalize on emerging bullish trends.

Conclusion

The Three White Soldiers candlestick pattern stands as a beacon of hope for traders seeking signs of a bullish turnaround. Its clear, visual structure and strong historical reliability make it a favorite among technical analysts. By understanding its formation, significance, and trading strategies, you can harness the power of this pattern to make more informed and profitable trading decisions.

Whether you’re a seasoned trader or just starting out, keeping an eye out for the Three White Soldiers can help you navigate the markets with greater confidence and precision.