- 2nd Floor - Building No. 02, Anupuram Vihar, Block Office Road, Haldwani

- +918979040814

- info@firstplan.in

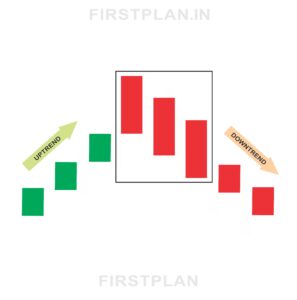

The Three Black Crows Candlestick Pattern Reveals Powerful Signals of Market Reversals and Downward Momentum

In the dynamic world of trading, identifying when a bullish trend is losing steam and a bearish reversal is about to unfold can be a crucial advantage. One of the most compelling and visually clear indicators of such a shift is the Three Black Crows candlestick pattern. This distinctive three-candle formation tells a story of sellers steadily gaining control, warning traders of potential downward momentum ahead. Understanding this pattern can help you anticipate market turns and make smarter trading decisions.

What Is the Three Black Crows Candlestick Pattern

The Three Black Crows pattern is a sequence of three consecutive bearish (red) candlesticks that typically appears at the end of an uptrend or during a consolidation phase. Each candle closes progressively lower than the previous one, signaling sustained selling pressure. The pattern suggests that sellers have taken over after a period of buying, potentially leading to a continuation of the downtrend or a reversal.

Key Characteristics of the Three Black Crows Pattern

Consistent Size and Shape

Position and Sequence

Color and Sentiment

Visualizing the Three Black Crows Pattern

Imagine a stock that opens at $100, falls to $95, and closes at $96 on the first day—a strong bearish candle signaling selling pressure. The next day, it opens at $95, drops to $92, and closes at $93, continuing the downward momentum. On the third day, the stock opens at $93, falls sharply to $88, and closes at $89, completing the pattern with a decisive bearish close. This sequence paints a clear picture of sellers steadily pushing prices lower.

What the Three Black Crows Pattern Indicates About Market Sentiment

The Three Black Crows pattern signals a significant shift from bullish optimism to bearish control. The consistent series of lower closes reflects growing confidence among sellers, suggesting that the uptrend has lost momentum. This pattern often foreshadows further declines, alerting traders to potential short-selling opportunities or the need to protect long positions.

How to Trade Using the Three Black Crows Pattern

Confirmation

Entry Point

Risk Management

Variations and Related Patterns

Additional Insights for Traders

Market Sentiment Dynamics

Ideal Trading Conditions

Importance of Trading Volume

Final Thoughts on the Three Black Crows Candlestick Pattern

The Three Black Crows pattern is a powerful visual cue that the market’s bullish phase may be ending and a bearish trend could be beginning. Recognizing this pattern allows traders to anticipate reversals early and position themselves to benefit from emerging downtrends. Whether you are an experienced trader or new to technical analysis, mastering the Three Black Crows pattern can enhance your market insight and improve your trading results.

By understanding the story these three candles tell, you gain a deeper appreciation of market psychology and momentum shifts, enabling smarter and more confident trading decisions.