- 2nd Floor - Building No. 02, Anupuram Vihar, Block Office Road, Haldwani

- +918979040814

- info@firstplan.in

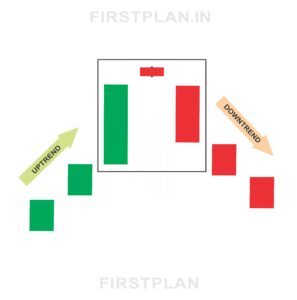

The Evening Star Candlestick Pattern and How It Signals Market Turning Points

In the intricate dance of financial markets, knowing when an uptrend is about to end can be a game-changer for traders. The Evening Star candlestick pattern is one of the most reliable and visually distinctive signals that a market reversal may be underway. This three-candle formation captures the shift from bullish optimism to bearish control, offering traders a powerful tool to anticipate downward trends and adjust their strategies accordingly.

Understanding the Evening Star Candlestick Pattern

The Evening Star is a classic three-candlestick pattern that typically appears at the peak of an uptrend. It signals that the market may be ready to reverse direction, moving from rising prices to falling prices. The pattern consists of:

Together, these candles tell a story of buyers losing strength and sellers beginning to dominate.

Key Features of the Evening Star Pattern

Size and Shape of Candles

Position and Gaps

Color Dynamics

Visualizing the Evening Star Pattern

Imagine a stock that opens at $100, rallies to $110, and closes at $108 on the first day—a strong green candle signaling buyer dominance. The next day, the price opens at $109, trades narrowly between $108 and $110, and closes at $109, forming a small-bodied candle that shows market hesitation. On the third day, the stock opens at $108 but plunges to close at $95, creating a large red candle that pierces well into the first day’s green candle. This sequence vividly illustrates the market’s transition from bullish to bearish control.

What the Evening Star Pattern Reveals About Market Sentiment

The Evening Star pattern captures a critical shift in market psychology. The large green candle shows buyers in control, the small indecisive candle reflects a pause and uncertainty, and the final large red candle confirms sellers have taken charge. This progression often marks the end of an uptrend and the beginning of a new downward movement.

How to Trade the Evening Star Pattern Effectively

Confirm the Signal

Entry Strategy

Risk Management

Variations and Related Patterns

Additional Insights for Traders

Market Sentiment Dynamics

Ideal Trading Conditions

Importance of Trading Volume

Final Thoughts on the Evening Star Candlestick Pattern

The Evening Star is more than just a pattern—it’s a narrative of market transformation. By recognizing this formation, traders gain valuable insight into shifting momentum and can position themselves to profit from emerging bearish trends. Whether you’re a seasoned trader or just beginning, mastering the Evening Star pattern can enhance your ability to spot market reversals and improve your trading outcomes.

Understanding the story told by these three candles offers a window into market psychology, helping you make smarter, more confident decisions in the ever-changing world of trading.