- 2nd Floor - Building No. 02, Anupuram Vihar, Block Office Road, Haldwani

- +918979040814

- info@firstplan.in

How the Bullish Piercing Candlestick Pattern Signals Market Reversals and Unveils New Buying Opportunities

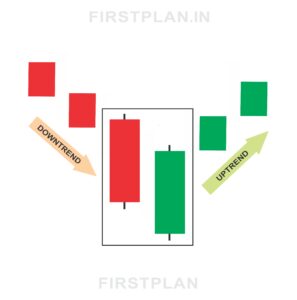

In the ever-changing landscape of financial markets, spotting early signs of a trend reversal can be the key to unlocking successful trades. One of the most insightful and visually distinctive patterns that traders rely on is the Bullish Piercing candlestick pattern. This powerful two-candle formation often marks the turning point from a downtrend to an upward rally, revealing the moment when buyers begin to regain control after a period of selling pressure. Understanding the Bullish Piercing pattern can help traders anticipate bullish momentum and position themselves advantageously.

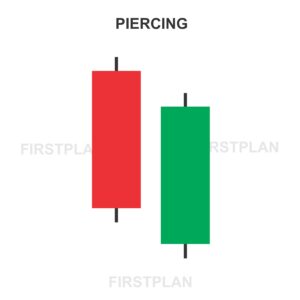

What Is the Bullish Piercing Candlestick Pattern

The Bullish Piercing pattern is a two-candlestick formation that typically appears at the end of a downtrend. It consists of:

This pattern signals that although the market opened with bearish sentiment, buyers stepped in strongly during the session, pushing prices significantly higher and suggesting a potential reversal to the upside.

Key Characteristics of the Bullish Piercing Pattern

To accurately identify the Bullish Piercing pattern, traders should focus on these defining features:

Visualizing the Bullish Piercing Pattern

Imagine a stock that opens at $100, falls to $90 during the session, and closes at $92, forming a large red candle that signals selling pressure. The next day, the stock opens lower at $91 but rallies strongly to close at $106, piercing well above the midpoint of the previous day’s candle. This dramatic turnaround captures the battle between bears and bulls, with buyers clearly taking control by the session’s end.

What the Bullish Piercing Pattern Indicates About Market Sentiment

The Bullish Piercing pattern reveals a critical shift in momentum. The initial bearish open followed by a strong bullish close suggests that selling pressure is weakening and buying interest is gaining traction. This pattern often marks the early stages of a bullish reversal, signaling traders to watch for further upward movement.

How to Trade the Bullish Piercing Pattern Successfully

Trading the Bullish Piercing pattern effectively involves confirmation and risk management:

Variations and Related Patterns

Why the Bullish Piercing Pattern Is Important for Traders

The Bullish Piercing pattern is a visually striking and reliable indicator of a shift from bearish to bullish sentiment. Its clear structure makes it easy to identify on charts, while its implications provide actionable insights into market psychology. By mastering this pattern, traders can improve entry timing, manage risk better, and increase the likelihood of capturing profitable upward moves.

Final Thoughts on the Bullish Piercing Candlestick Pattern

The Bullish Piercing candlestick pattern captures a pivotal moment in market dynamics—the transition from selling dominance to buying strength. Recognizing this pattern empowers traders to anticipate bullish reversals early and adjust their strategies to capitalize on emerging trends. Whether you are a seasoned trader or just starting, understanding the Bullish Piercing pattern can enhance your market analysis and trading performance.

By paying close attention to these two candles, you gain valuable insight into the subtle shifts that drive price action and market momentum, enabling smarter and more confident trading decisions.