- 2nd Floor - Building No. 02, Anupuram Vihar, Block Office Road, Haldwani

- +918979040814

- info@firstplan.in

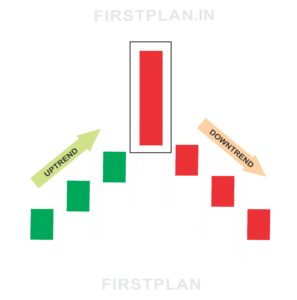

Unleashing the Power of the Bearish Marubozu Candlestick Pattern for Market Downturns

In the intricate world of trading, understanding when sellers take full control of the market can be just as valuable as spotting buying opportunities. One of the clearest and most compelling indicators of strong selling pressure is the Bearish Marubozu candlestick pattern. This single-candle formation signals decisive bearish momentum and often marks the beginning of a downtrend or the continuation of falling prices. Mastering this pattern can empower traders to anticipate market shifts and position themselves advantageously.

What Is the Bearish Marubozu Candlestick Pattern

The Bearish Marubozu is a powerful candlestick pattern characterized by a single, solid red candle with no wicks or shadows on either end. This means the price opened at its highest point and closed at its lowest, reflecting unwavering control by sellers throughout the entire trading session.

This pattern typically appears at the start of a downtrend or during periods of intensified bearish momentum. It sends a clear message: sellers are dominating the market, and buyers offered no meaningful resistance. For traders, the Bearish Marubozu is a strong signal that downward price movement is likely to continue or that a reversal from an uptrend may be underway.

Key Characteristics That Define the Bearish Marubozu

To spot a Bearish Marubozu with confidence, look for these essential features:

Visualizing the Bearish Marubozu

Imagine a stock that opens at ₹120 and steadily declines throughout the trading session, closing at ₹100. There are no price spikes above or below the opening and closing levels—just a solid red candle stretching from top to bottom. This lack of shadows or wicks indicates that sellers maintained full control from the first trade to the last.

What the Bearish Marubozu Reveals About Market Sentiment

The Bearish Marubozu reflects overwhelming bearish sentiment. Its formation means sellers dominated the entire session, pushing prices lower without interruption. This pattern signals growing confidence among sellers that the market will continue to decline, making it a critical warning sign for traders to consider short positions or tighten risk controls on long trades.

Real-World Example of the Bearish Marubozu

Consider a stock that opens at ₹120, with no upward price fluctuations during the session, and closes firmly at ₹100. This uninterrupted downward movement creates a Bearish Marubozu candlestick. The absence of any wicks shows buyers were unable to push prices higher, highlighting the strength of the selling pressure.

How to Trade the Bearish Marubozu Pattern Effectively

To harness the power of the Bearish Marubozu, traders should combine pattern recognition with disciplined risk management:

Variations and Related Patterns

Additional Insights for Traders

Understanding Market Psychology

The Bearish Marubozu is a vivid expression of sellers’ dominance. The absence of shadows means buyers were effectively sidelined, unable to push prices higher even momentarily.

Ideal Trading Conditions

This pattern is most reliable when it appears after a sustained uptrend or during a corrective pullback within a downtrend. Its large size and clean shape enhance its predictive power.

The Role of Trading Volume

Higher volume during the Bearish Marubozu formation signals stronger conviction among sellers, making the bearish signal more trustworthy.

Visual Summary of the Bearish Marubozu

This simple yet powerful candlestick offers a clear window into market sentiment and momentum.

Final Thoughts on the Bearish Marubozu Pattern

The Bearish Marubozu candlestick is a compelling indicator of strong selling pressure and potential downward trends. Its unmistakable shape and clear message make it an essential tool for traders aiming to anticipate market reversals or confirm bearish momentum. By mastering this pattern and combining it with sound trading strategies, you can better navigate the markets and seize opportunities to profit from falling prices.

Whether you are an experienced trader or just beginning, recognizing the Bearish Marubozu can provide valuable insights into market dynamics and help you make more informed trading decisions.