- 2nd Floor - Building No. 02, Anupuram Vihar, Block Office Road, Haldwani

- +918979040814

- info@firstplan.in

How the Bearish Engulfing Candlestick Pattern Reveals Market Reversals and Guides Smart Trading Decisions

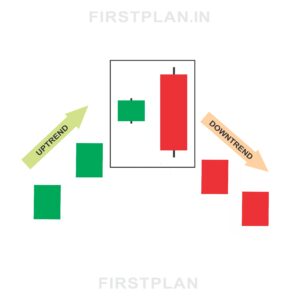

In the fast-moving world of financial markets, knowing when an uptrend is about to reverse can be the difference between profit and loss. One of the most reliable and visually striking signals of a potential market downturn is the Bearish Engulfing candlestick pattern. This powerful two-candle formation signals that sellers have taken control after a period of buying, often marking the start of a new downtrend. Understanding this pattern can help traders anticipate shifts in momentum and position themselves for success.

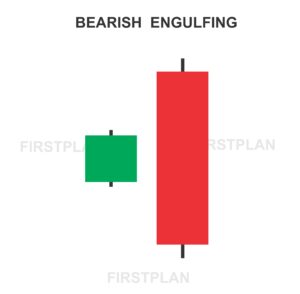

What Is the Bearish Engulfing Candlestick Pattern

The Bearish Engulfing pattern is a classic double candlestick formation that usually appears at the peak of an uptrend. It consists of two candles:

This pattern reveals a dramatic shift in market sentiment as sellers overwhelm buyers in a single session, pushing prices significantly lower and signaling a potential reversal from rising to falling prices.

Key Characteristics of the Bearish Engulfing Pattern

To identify the Bearish Engulfing pattern clearly, traders should focus on these defining features:

Visualizing the Bearish Engulfing Pattern

Picture a stock that opens at $100, climbs to $110, and closes at $108, forming a small green candle representing buying strength. The very next day, the stock opens slightly lower at $107 but plunges to close at $95, creating a large red candle that completely engulfs the previous day’s body. This stark reversal captures the battle between buyers and sellers, with sellers decisively taking control.

What the Bearish Engulfing Pattern Signals to Traders

The Bearish Engulfing pattern is a clear indicator that selling pressure has overtaken buying pressure. The large bearish candle shows sellers dominating the session, often marking the end of an uptrend and the beginning of a downward move. This pattern alerts traders to potential market weakness and the opportunity to enter short positions or protect existing long trades.

How to Trade the Bearish Engulfing Pattern Effectively

To leverage the Bearish Engulfing pattern in your trading, follow these strategic steps:

Variations and Related Patterns

Why the Bearish Engulfing Pattern Is Essential for Traders

The Bearish Engulfing pattern is both visually distinctive and highly informative. Its clear structure makes it easy to spot on charts, while its implications provide actionable insights into market sentiment shifts. By mastering this pattern, traders can improve timing, reduce risk, and increase their chances of entering trades at the start of profitable downtrends.

Final Thoughts on the Bearish Engulfing Candlestick Pattern

The Bearish Engulfing candlestick pattern offers a vivid snapshot of a market turning point where sellers decisively overpower buyers. Recognizing this pattern empowers traders to anticipate bearish reversals and adjust their strategies accordingly. Whether you are a seasoned trader or new to technical analysis, incorporating the Bearish Engulfing pattern into your toolkit can enhance your ability to navigate the markets with confidence and precision.

By understanding the story told by these two candles, you gain valuable insight into market psychology and momentum shifts that drive price action. This knowledge is crucial for making informed, strategic trading decisions that capitalize on the market’s natural ebb and flow.